Margins and Value at Risk

Value at Risk

The value at risk (also known as value at risk or VaR) is a measure of risk applied to financial investments. This measure indicates the potential loss of an investment position over a certain time horizon, usually 1 day, with a certain confidence level, usually of 95% or 99%. It is a technique commonly used by investment banks to measure the market risk of the assets they hold in the portfolio, but it is also a broader concept that has multiple applications. (source Wikipedia)

Margins

The margin is the term that identifies the value of the money that is requested by the broker to guarantee the counterparty of each derivative contract. The value of the money requested therefore represents the risk of the transaction itself and will be adjusted, compensated, as the risk changes.

Selling option contracts requires margin, instead buying them doesn’t because the buyer has the right and not the obligation to exercise the contract and therefore the amount of the premium paid is the maximum amount required.

The seller, on the other hand, has an initial margin, that is calculated at the moment in which the position is assumed and then compensated as this operation becomes more or less risky, or even if in the strategy the characteristics have been modified or by buying options that delimit the risk or by selling options of a contrary series (call against put, for example).

The broker must therefore have as guarantee all the money that could be used at any time to satisfy all the counterparties. This money is paid to the Compensation and Guarantee Fund, which is the body in charge. However, it happens that the Broker increases the margin required by the CC & G, perhaps because it has the majority of customers who are exposed to a part (down or up) or to a sector (pharmaceutical, banking, etc.). It is clear that the portfolio held by the broker has an overall riskiness that varies from the sum of the positions and therefore the margin required for each customer will be, for the same operation, different from broker and broker, from one day to the other.

Naked Margin is used in beeTrader as the margin with risk-defined strategies coincides with the maximum risk and it is not necessary to calculate it, or rather you know, in the event of a spread, if you close the bought part first what will be the required margin. However it is possible to adjust the beeTrader margin with that actually requested by the broker, this operation can be done strategy by strategy or by portfolio.

Margins adjustment

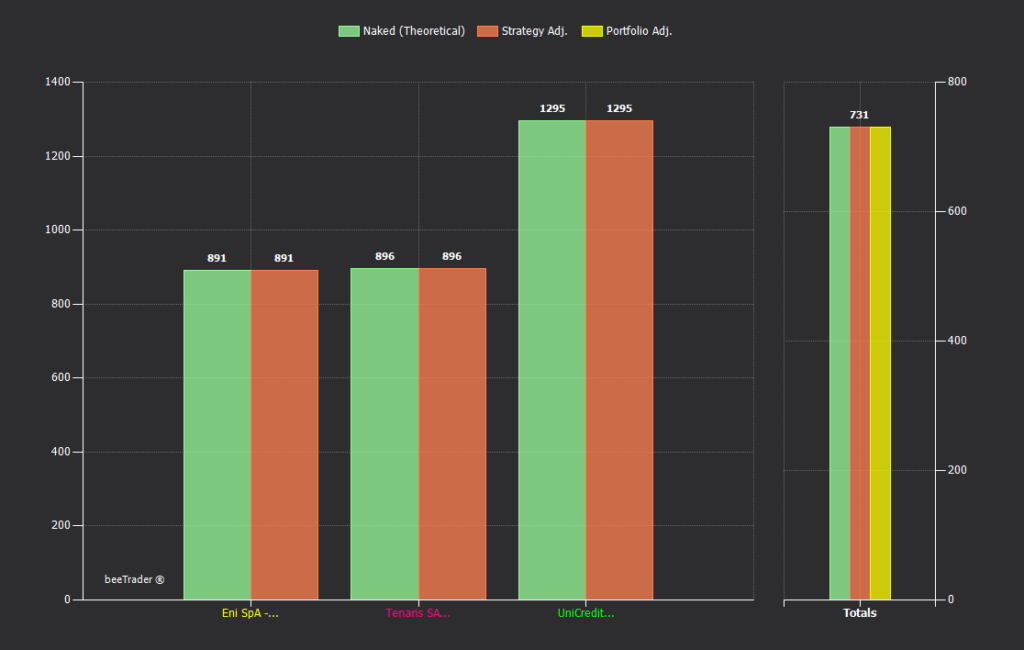

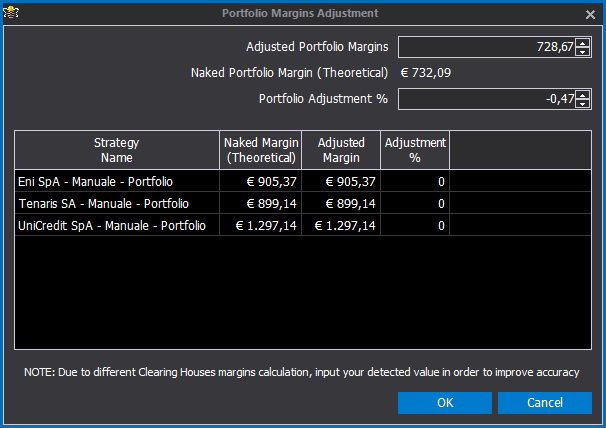

At the beginning the beeTrader Naked Margin and the Adjusted Margin coincide. We will see later how to modify the beeTrader margins, the first strategy for strategy and then the inside of the portfolio in a single step.

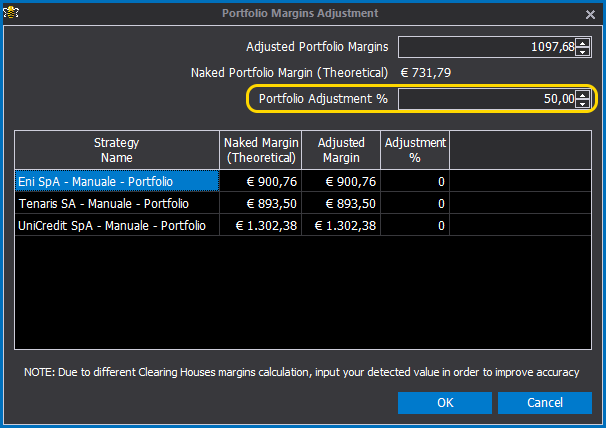

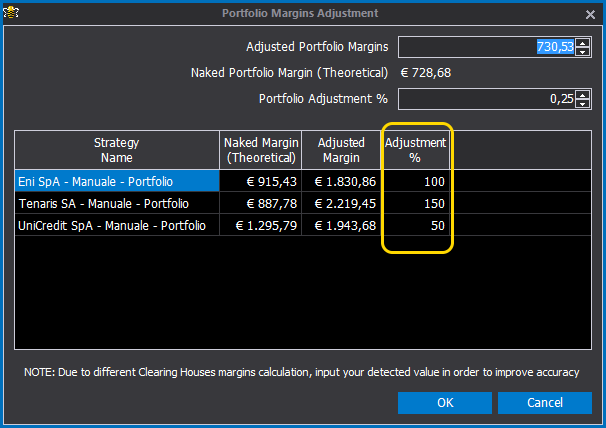

Clicking the Margin Adjustment button opens the window that allows you to make changes. In the case below, the margin for Eni’s strategy is increased by 100%, the margin for that of Tenaris by 150%, the margin for that of Unicredit by 50%.

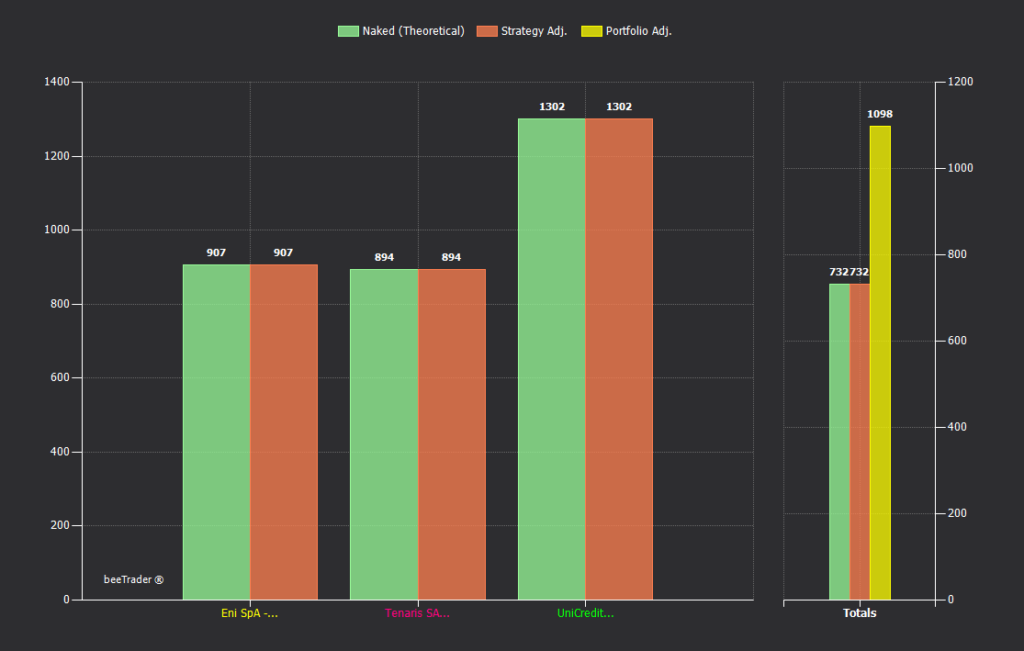

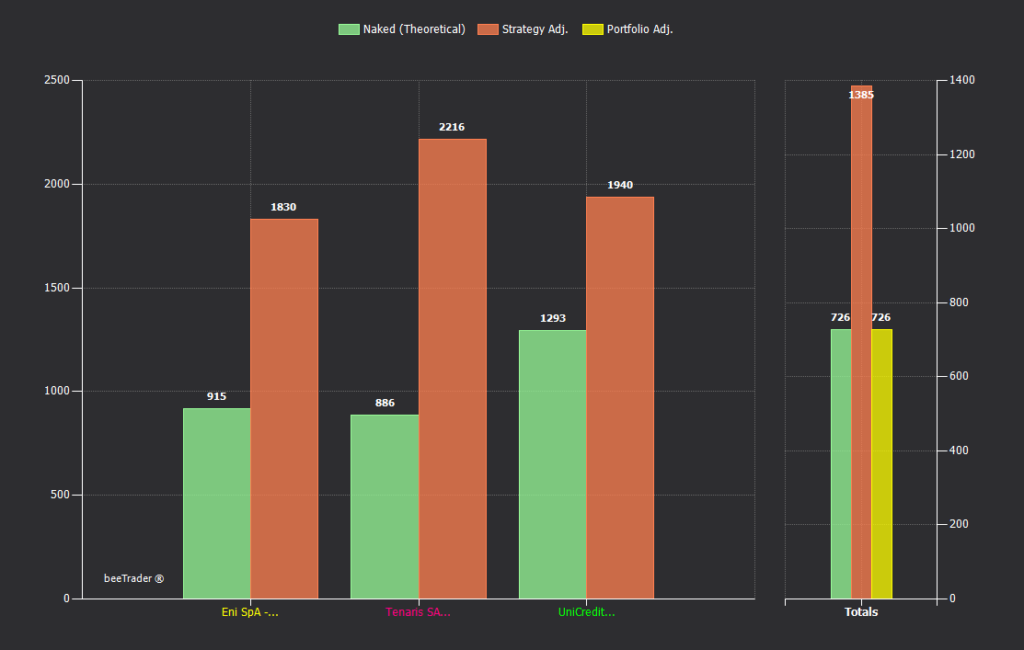

As you can see, the histograms of the strategies show the change made.

Now instead, always clicking on the Margin Adjustment button, we are going to increase the margin of the portfolio inside by 50%. The corresponding histogram (right) aligns with the operation performed.